World Mission Society Church of God Financial Statements Raise Questions

“Tithe is a minimum rent to be paid to God in this world.”

My Sheep Listen To My Voice by General Pastor Joo Cheol Kim p. 297

Over the years, the financial status and practices of the World Mission Society Church of God have been an issue of contention not only on this site, but on other blogs (here and here for example) that date back approximately 10 years. In July of this year, the judge in the case of World Mission Society Church of God vs. Colón revised a Confidentiality Order which previously prohibited the dissemination of financial documents produced by the WMSCOG in the discovery process. (A copy of the revised court order is available below). The documents produced by the WMSCOG in Ridgewood, NJ (also available below) provide an overview of the profits and losses between 2009 and 2012. A review of the financial documents produced raises some serious questions.

1. The total assets and cash increased exponentially between 2009 and 2012, despite the WMSCOG’s claim for $25 Million in damages (loss) in the lawsuit they filed in Virginia in 2011. The WMSCOG reported a gain of over $10 Million dollars more in cash and assets in 2012 than in 2009.

| 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|

| Regular Tithes & Offerings | $2,707,567 | $3,338,607 | $5,019,117 | $7,542,639 |

| Total Assets | $10,072,639 | $12,049,126 | $15,977,088 | $20,991,291 |

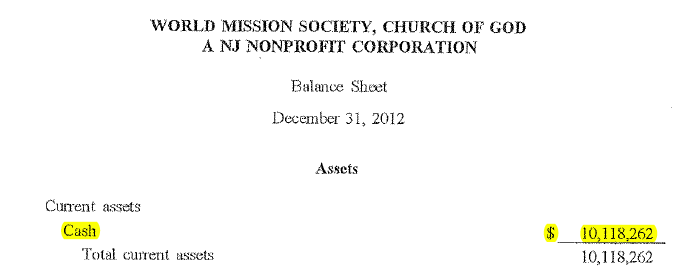

In 2012, the WMSCOG in Ridgewood, NJ claimed to have over $10 Million dollars in cash and over $20 Million in total cash and assets (this includes property). It is unclear as to which other WMSCOG locations may be included in these figures. Why would an organization that has reportedly claimed that the world was going to end in 2012, accumulate this kind of wealth? Have other main WMSCOG locations like California, Illinois, and South Korea accumulated the same? Where is this money going?

2. In each of the four years covered in the financial documents, the Ridgewood location claims an amount listed as “Support to other Churches”. During the Tithes & Offerings study, former members have reported being told that all money donated to the church was sent to South Korea to be distributed to other churches by the General Assembly. Not only was the WMSCOG in Ridgewood, NJ distributing money to other locations, but the amount of money reportedly distributed increased from $58,821 in 2009 to $1,084,877 in 2012. So is the money sent to South Korea or is it distributed directly to other churches?

3. In each of the four years covered, the WMSCOG listed an expense for “Books and tapes”. Interestingly, in 2009 there was no expense listed for books and tapes and this expense later claimed increased from a mere $1,275 in 2010 to $80,491 in 2012. Former members reported having to buy their church related books and music CDs. If the church is buying these items or paying the cost to produce them and then charging the members money to buy them, where is the amount of cash generated in the sale of these books and tapeslisted?

4. In 2012 the WMSCOG in Ridgewood, NJ claims to have spent $100,000 in Payroll and $7,223 in Payroll taxes. Former members that attended this location reported being told that “no one gets paid”. Organizations only pay payroll taxes if they have employees. Therefore, to whom is this WMSCOG location paying a salary?

5. In 2010 the WMSCOG in Ridgewood, NJ claimed an expense of $100,000 for a “Contribution”. The WMSCOG reportedly made a $100,000 donation to the UN for hurricane relief in Haiti. The UN website and the official World Mission Society Church of God website state that the money was raised “through ‘The Messiah Orchestra Concert’ held in Busan”. If the money for the contribution was raised during a concert in South Korea, how can the Ridgewood, NJ location claim this contribution as an expense? Did the WMSCOG in Ridgewood make a separate donation to another organization in 2010? An online search for information such as a press release detailing another $100,000 contribution made by the WMSCOG in 2010 did not produce any results. The WMSCOG’s public relations campaign has been quite active in recent years, so it seems unlikely that they would let an opportunity for public praise slip away. (If you have a link to a press release that was written about a separate donation by this organization in 2010, please comment below). It is also noted that 2010 was the only year where a contribution was listed as an expense.

6. The WMSCOG also listed the following expenses for “Meals”.

| 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|

| Meals | $0 | $8,371 | $5,396 | $18,294 |

Former members have reported having to pay for and prepare meals when their respective teams are assigned to cook for the congregation. So who’s meals is the WMSCOG in Ridgewood claiming to pay for? Why is there no expense for meals listed for 2009?

7. The WMSCOG in Ridgewood, NJ also claimed the following amounts in “Miscellaneous” and “Other” expenses.

| 2009 | 2010 | 2011 | 2012 | Grand Total | |

|---|---|---|---|---|---|

| Miscellaneous | $382 | $251 | $1416 | $4275 | |

| Other | $75,426 | $52,705 | $342,173 | $221,784 | |

| Total | $75,808 | $52,956 | $343,589 | $226,059 | $698,412 |

Over the span of four years, $698,412 is designated as miscellaneous and other? Current members should seriously consider the information that was submitted to the court by the World Mission Society Church of God in Ridgewood, NJ before possibly signing away their tax refund, emptying out their retirement account, maxing out their credit cards, selling their property, writing another check or putting another dollar into any WMSCOG tithe, other offering, or brown envelopes.

WMSCOG-Financial-Documents-07-18-14WMSCOG-vs-Colon-Confidentiality-Order-07-23-15-1