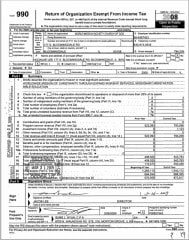

World Mission Society Church of God IRS Form 990 Bloomingdale, IL

IRS Form 990 WMSCOG Illinois

Page 1

Jacob Lee is listed as the director and to members he is known as pastor Jacob Lee. Jae Hoon Lee is listed as the principal officer.

Page 4

Note Line 28a. The WMSCOG denies that any of the officers have a direct business relationship through ownership in another entity.

It just so happens that the Pastor from the Ridgewood, NJ location, Dong IL Lee (a.k.a. Daniel Lee), owns a company named Big Shine Worldwide, Inc. (a.k.a. Big Shine Automation, IC Win, Philo Tech). See the Big Shine Worldwide, Inc business entity certificate for NJ below, where Dong Il Lee is listed as the President.

Big Shine Worldwide, Inc is a registered business in Illinois as well. See the business entity certificate below.

5-Big-Shine-Worldwide-ILDong IL Lee is also listed here as the President, and Jae Hoon Lee is listed as the Secretary of Big Shine Chicago (“assumed name” on the bottom of the certificate). Also note Sung L Hyun is listed as the registered agent on the business status report, and is also the accountant listed on Page 1 of the 990. It is left to the reader to draw his or her own conclusions about whether or not a business relationship exists.

Page 6

Note Line 9a. The WMSCOG claims not to have any chapters, branches, or affiliates. Yet, on page 19 of the 990 below, the Texas church which the WMSCOG in Illinois claims to have purchased for $475,000 (line item 6).

Pages 7 & 8

In contrast to the the application for tax exempt status that the WMSCOG in Illinois (see Schedule A, page 12) filed in 2000, on the 990, they claim not to pay any of their Pastors. Why would they claim to begin paying full-time pastors a salary in 2001, but not include the any salaries on the 990 they filed 9 years later? Did the pastors get paid or not? If the pastors are not paid, how do the Pastors make a living? How do they pay for their basic expenses? Are they all independently wealthy? Well we can assume that Jae Hoon Lee is getting a paycheck from Big Shine Chicago where he is listed as the company’s secretary.

Page 9

Note Line 2a. Between 2004 and 2008, the WMSCOG in Illinois claims to have collected over $2 Million dollars in donations (page 16), of which $793,086 (line 2g) was collected in 2008 alone. Where did all of this money go?

Note Line 2b. The WMSCOG in Illinois claimed not to have any chapters, branches, or affiliates on page 6, yet here they claim that they received $26,354 from a “parental church“. Is this “parental church” the General Assembly in South Korea?

Page 10

Page 10–Note Line 24a. The WMSCOG claims to have spent $328,843 on “missionary” expenses. Former members have reported that they are expected or assigned to pay for the food served to the members at the church, floral arrangements, utilities (brown donation envelopes), numerous internet blogs (internet team/mission), expenses and plane tickets to Korea, etc., then what was this money used for?

Page 16

Note Section A Part 1. It shows that the organization was growing exponentially, and over the course of 5 years accumulated $2,096,343 in donations, gifts, grants, etc. Again, do the members know how this money was spent? Does the WMSCOG print this information for its members? Is there an annual report available to its members? Members should seriously consider the complete lack of financial transparency before making any donations to an organization that teaches that these donations are required for their members’ salvation.

1-Bloomingdale-IL-990-2008

Form 990-T

Part I: Unrelated trade or business income.. After reading the instructions on how to fill this out, I’m not sure if the Zion store is included in this section. There was an example saying a social group would report their bar or restaurant earnings. Would the store of a church be considered unrelated to the church? IMO, yes because services would continue with or without the store. But that’s just what I think.. What the real answer?